Sotheby’s is making rapid inroads into the digital sphere and has continuously one-upped rival Christie’s throughout 2020. The famous auction house, however, is facing significant risks concerning a potential credit rating downgrade, as well as the various scandals and legal proceedings which have tarnished its image this year. Will Sotheby’s manage to sail smoothly through the public health crisis?

“Like a time machine, the public health crisis emerged from the distant past and has pushed us into the future in several respects. Experts’ predictions about how much progress would be made in digitalisation by 2025 have instead become reality within less than a year.”

Writing in Le Monde, Philippe Escande is remarkably accurate when describing the acceleration in digitalization that Covid-19 has set in motion across a variety of different sectors. The major auction houses are no exception to the rule and have done their best to overcome the impact that successive lockdowns have had on their ability to hold in-person auctions. Unsurprisingly, they have banked on online sales in order to compensate for the closure of their showrooms.

Picking up the pace of digitalisation, but sparks flying

“We have carried out a massive shift from in-person sales to no less than 200 online sales, which will make up between 8 and 10% of our turnover as opposed to between 1 and 2% last year. Next year, roughly half of all sales will probably take place online”, explained Guillaume Cerutti, the CEO of Christie’s. In this respect, however, it’s Sotheby’s which has taken the lead, opening up a turnover gap of 40%.

Extremely quick to react to these unusual circumstances, the New York auction house ramped up its online sales, in particular thanks to unique hybrid “sealed bid” auctions. Last summer, the auction house sent some extremely positive signals to the entire art world by selling, online and over the telephone from London, a Francis Bacon triptych for $85 million. Over the past few years, Sotheby’s has deftly adapted itself to a changing world by developing digital technologies and acquiring assets to help it compensate for the slowdown in the art market. By developing services complementary to its sales, such as the shipping of works or financing offers, as well as services for the auction house’s wealthiest clients, the auction house’s growth is expected to be supported by a number of ongoing transformations.

Be that as it may, Sotheby’s has also been coping with a number of scandals which are unlikely to do it any favours. As part of the investigations into the financial affairs of Jeffrey Epstein, the notorious sexual predator who killed himself in a Brooklyn prison in 2019, Sotheby’s has been subpoenaed by authorities in the US Virgin Islands, requiring the auction house to hand over “all documents reflecting or relating to inquiries, sales, bis; communications with or about Jeffrey E. Epstein”. According to Artnet, the transactions concerned involve two works by Paul Cézanne and one Picasso. The combined value of these three paintings is believed to be some $139 million. It remains to be seen what the exact connection was between these dubious acquisitions and Jeffrey Epstein who was known to use a number of go-betweens for his transactions. The company apparently tasked with reselling the works has been linked to Leon Black, the president of the Museum of Modern Art (MoMA) in New York.

The Yves Bouvier affair and the Isaac Sultan scandal

In fact, in the Epstein case, the entire art world seems to be in the justice department’s sights. The British auction house Christie’s has also received a subpoena regarding the disgraced American financier, as have a number of prominent figures at MoMA. In Sotheby’s particular case, however, this legal entanglement stirs up recollections of other recent affairs that the auction house has been involved in. Just this November, the Attorney General of New York, Letitia James, sued the firm for allegedly costing taxpayers millions of dollars in unpaid sales tax. “Sotheby’s violated the law and fleeced New York taxpayers out of millions just to boost its own sales. This lawsuit should send a clear message that no matter how well-connected or wealthy you are, no one is above the law.”

In the 40-page-plus complaint, filed on November 6th with the New York State Supreme Court, the government lawyers affirm that Sotheby’s “helped wealthy clients evade taxes to boost its own sales”. In particular, the auction house apparently helped a client avoid taxes by providing him with documents giving him tax benefits reserved for art dealers, not available to private collectors. According to the Wall Street Journal, the collector in question is Isaac Sultan, the president of Atlantic Feeder Services USA LLC in Miami. Sultan is known for being a collector of Latin American and contemporary art.

Sotheby’s is also mixed up in another prominent case, the “Bouvier Affair”, which takes its name from the Swiss art dealer Yves Bouvier, who has developed a toxic reputation in the business world. The “Commitments and Contingencies” section of Sotheby’s Annual Report highlights a lawsuit in which the Russian billionaire Dmitry Rybolovlev is demanding that Sotheby’s compensate him to the tune of $380 million in damages in exchange for the auction house’s apparent complicity in the alleged fraud carried out by Yves Bouvier.

According to the plaintiff, the auction house facilitated 12 out of the 38 transactions between Yves Bouvier and Rybolovlev: “Sotheby’s was the willing auction house that knowingly and intentionally made the fraud possible. Sotheby’s actions instilled Plaintiffs’ trust and confidence in Bouvier and rendered the whole edifice of fraud plausible and credible.” According to Dmitry Rybolovlev, Yves Bouvier cheated him out of staggering sums—close to $1 billion—including with the complicity of Sotheby’s through the intermediary of Samuel Valette, the Vice President of Sotheby’s Private Sales. The two apparently sold $600 million of artwork to Bouvier over a three-year period, after having agreed together with him on the prices to suggest to the final client for these artworks. Bouvier then apparently resold these works to Dmitry Rybolovlev with margins of more than 30% coming on top of the 2% commission that he received from Rybolovlev on each work in exchange for acting as his agent. Last year, the New York district court rejected Sotheby’s request to keep hidden damaging correspondence between Yves Bouvier and Samuel Valette regarding the cost of the artworks in question. Sotheby’s, meanwhile, rejects all of the allegations and argues that the lawsuit is baseless.

Patrick Drahi’s arrival at the head of Sotheby’s

In 2019, seven months before the beginning of the current public health crisis, Sotheby’s was bought by Franco-Israeli billionaire Patrick Drahi for $3.7 billion. Could the arrival of the Altice founder help Sotheby’s weather the Covid crisis and put an end to the scandals which have tarnished the prestigious auction house’s image?

At the end of 2019, Sotheby’s was carrying $1 billion in long-term debt. In March 2020, Patrick Drahi was forced to make budget cuts in order to confront the financial losses caused by the pandemic. In April, the auction house laid off roughly 12% of its staff (200 employees lost their jobs) and lowered the salaries of the remaining employees. At the end of April, an auditors’ report from Deloitte highlighted the financial difficulties the company is facing, including a net loss of $71.2 million and $467 million in debt.

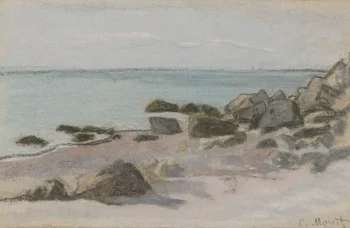

Before his purchase of Sotheby’s, Patrick Drahi was mostly known in the art world as a collector of Impressionist and Art Nouveau art. There were even rumours that Samuel Valette, the Sotheby’s Vice President of Private Sales, was his personal adviser. Drahi’s efforts to shake up the management of the auction house, curiously enough, don’t appear to have affected Valette, since Sotheby’s seems wary of giving up access to his impressive network of contacts.

The Deloitte report also listed a number of risks which Sotheby’s may be confronted by in the short term, notably potential losses stemming from the ongoing lawsuits. On November 20th, the auction house faced a fresh challenge: Moody’s was unpleasantly surprised by Sotheby’s moves to increase its debt burden, causing the ratings agency to warn that the auction house might see its credit rating slip.

In the extremely challenging context of the Covid-19 pandemic, combined with ongoing litigations, the auction house should overhaul its management strategy and do more to address its missteps. But how can one turn around Sotheby’s waning fortunes? For its top management, a first place to start could be to take a closer look at the structural issues laid bare by the various lawsuits the venerable firm is fighting against.